High Deductible Health Plans (HDHPs) have gained popularity in recent years as an alternative to traditional health insurance options. These plans offer a unique approach to managing healthcare expenses. In this comprehensive guide, we will explore what a High Deductible Health Plan is, how it works, its benefits, potential drawbacks, and important considerations.

Understanding High Deductible Health Plans

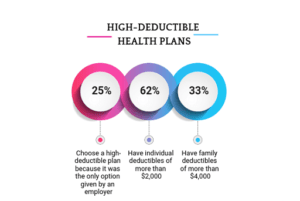

High Deductible Health Plans are a type of health insurance that comes with a significantly higher deductible than traditional health insurance policies. The deductible is the amount you must pay out of pocket for medical expenses before the insurance plan starts covering the costs. Here are some key aspects to consider:

What Defines a High Deductible?

- High Deductible Health Plans are characterized by their high deductible amount, which is set by the Internal Revenue Service (IRS) and is subject to change annually. For 2022, the minimum deductible for an individual was $1,400, and for a family, it was $2,800.

- The maximum out-of-pocket limit is also defined by the IRS and varies each year. For 2022, the limit for an individual was $7,050, and for a family, it was $14,100.

How HDHPs Work

- With an HDHP, you are responsible for covering all of your medical expenses until you reach your deductible. After that, the insurance plan will typically cover a portion of your healthcare costs.

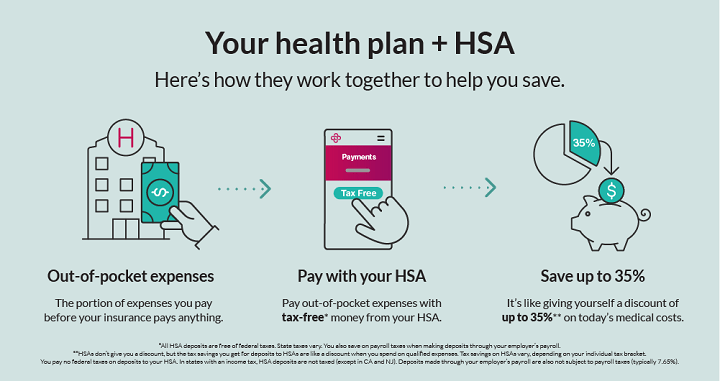

- The money you spend on qualified medical expenses can often be tax-deductible or contribute to a Health Savings Account (HSA), providing a potential tax advantage.

Benefits of High Deductible Health Plans

High Deductible Health Plans offer several advantages that may be appealing to individuals and families:

Lower Premiums

- One of the primary benefits of HDHPs is that they typically have lower monthly premiums compared to traditional health insurance plans. This can be a significant cost-saving for those looking to reduce their monthly expenses.

Health Savings Account (HSA)

- HDHPs often come with the option to open a Health Savings Account (HSA). HSAs allow you to save money tax-free for qualified medical expenses, which can provide long-term financial benefits.

Flexibility

- HDHPs can be suitable for people who are generally healthy and don’t anticipate many medical expenses. They provide the flexibility to pay for routine healthcare costs out of pocket and save on premiums.

Drawbacks and Considerations

While High Deductible Health Plans have their advantages, they also come with potential drawbacks and important considerations:

High Out-of-Pocket Costs

- The most significant drawback of HDHPs is the high deductible. This means you’ll have to pay a substantial amount for medical expenses before insurance coverage kicks in, which can be challenging for some individuals.

Risk of Financial Strain

- If you have unexpected or high healthcare costs early in the year, meeting the deductible may strain your finances. It’s important to plan for this possibility.

Limited Preventive Care Coverage

- Some HDHPs offer limited coverage for preventive services before the deductible is met, so it’s essential to understand the plan’s specifics.

Who Should Consider an HDHP?

High Deductible Health Plans are not suitable for everyone. They may be a good option for:

- Young, healthy individuals or families who don’t anticipate many medical expenses.

- Those who want to take advantage of the tax benefits of an HSA.

- Individuals who can comfortably cover the high deductible amount.

High Deductible Health Plans offer an alternative approach to managing healthcare costs. While they can provide cost savings and tax advantages, they also come with the responsibility of a higher deductible. Before choosing an HDHP, it’s crucial to carefully assess your healthcare needs, financial situation, and risk tolerance. Understanding the advantages and drawbacks of HDHPs is essential in making an informed decision about your health insurance coverage.